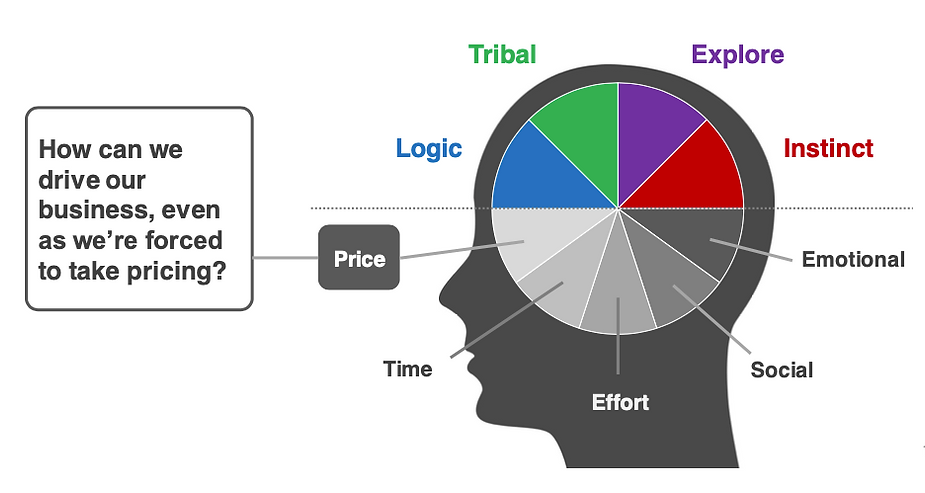

Fortunately, neuroscience gives us the strategic tools to elevate above the ‘price barrier.’

The key is that not ALL consumers will react the same way. In fact, when it comes to the psychological barrier of price, there are THREE mindsets, and understanding them can help companies craft their strategy for taking necessary pricing.

On Monday, Hunter joined IRI’s Lance Goodridge and RBC Capital Markets’ Nik Modi to discuss the inevitable price increases we’ll see across CPG categories in 2022, and what companies should think about as they pass along price increases to consumers.

RBC (and almost certainly the rest of Wall Street) believes that “tracking price realization and the evolution of price elasticities will be key in 2022.” The simple fact is that most producers have been shielding consumers from the full extent of their price increases so far, as evidenced by the “widest [gap] in history” between the increase in the producer price index (PPI) vs. the consumer price index (CPI) to date.

RBC argues this gap is not sustainable, thus more price increases for consumers will be necessary. Further, IRI’s price sensitivity analyses indicate price elasticities are starting to revert to pre-COVID levels for most packaged food categories.

That’s the ‘bad news.’

The BETTER news is that neuroscience reveals consumers subconsciously react to price in one of three ways, and only ONE actually cares about the prices themselves. Unpacking these mindsets provides some helpful heuristic hacks to make pricing increases less punitive in consumers’ minds.

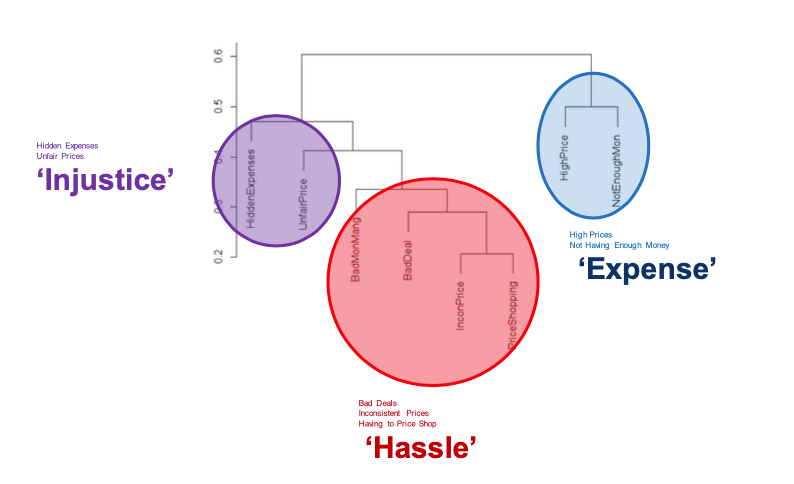

Our Omni-Pulse tracker and database reveal that the first mindset reacts in the way you probably expect, troubled by EXPENSE itself: these tend to be lower-income consumers who worry about not having enough money to make purchases.

However, there is another group who cares more about the INJUSTICE of pricing: they are more bothered by feelings of unfairness or hidden expenses.

The third group reacts negatively to the HASSLE of having to price shop, inconsistent pricing, or feeling they’re getting a bad deal. This “Hassle” cohort is a desirable target for CPG marketers: it skews younger, more diverse, higher income, and is more engaged with CPG brands in categories like CSDs.

3 profiles in terms of how people perceive ‘price’:

Drawing from this insight, Hunter offered three ideas for softening the blow of price increases:

Lower the cost of ‘getting’ if you can’t lower the cost of ‘buying’ (free shipping, promotions, etc.).

Tie price increases to innovations / product improvements.

Offer something ‘extra’ to increase the value consumers derive from the purchase (i.e.: access to exclusive content).

So, as we brace for changing behaviors that price increases can bring, remember there are tools at our disposal to adjust the consumer focus, and successfully navigate the price barrier.